add

Gov. Evers Announces More Than $200 Million for Wisconsin Communities Through ARPA State and Local Fiscal Recovery Funds

Funds ensure local communities can invest in unique needs toward ensuring economic recovery

MADISON — Gov. Tony Evers announced today that $205,769,426 has been directed to the 1,825 participating Wisconsin local governments under the American Rescue Plan Act’s (ARPA) State and Local Fiscal Recovery Funds (SLFRF) program.

“I am very pleased to report that so many of our local communities and governments are taking advantage of these federal funds to make improvements in their communities that they otherwise would not have had the funds to do,” said Gov. Evers. “From addressing the public health impacts of the pandemic to investing in needed critical infrastructure, to helping ensure families and businesses financially recover, these funds will allow local governments to invest in their community's unique needs and will make a major difference for Wisconsinites across our state.”

The funds were directed to cities, towns, and villages with a population of less than 50,000 in Wisconsin by the federal government under the ARPA SLFRF program. The amount allocated to each local government is based on a specific formula largely based on population.

“I'm very proud of the work of the DOR team and our partner organizations who worked tirelessly to answer questions from the local governments, thereby making the 99.99% success rate possible,” said Department of Revenue (DOR) Secretary Peter Barca. “Local leaders told us how vital their funds will be to their recovery and that of their local citizens.”

Under the SLFRF program, counties, large municipalities, and tribal governments received their own allocation from the federal government. Non-entitlement units, those under 50,000 in population, received their distribution from the state. The DOR, in conjunction with the Department of Administration (DOA), has been working to ensure that all Wisconsin non-entitlement units apply for and receive their share of these ARPA dollars. The state also worked closely with the Wisconsin Towns Association and the League of Wisconsin Municipalities to alert all 1,828 local governments of the opportunity for these ARPA dollars and assist them in creating plans to spend the dollars in accordance with U.S. Treasury guidance.

“The COVID-19 pandemic touched every corner of our state, and in many cases the ARPA SLFRF funds provided a much-needed lifeline to our communities,” said DOA Secretary Joel Brennan. “Thanks to the key partnerships which made this successful roll-out possible, we’re now able to see our local economies bounce back stronger than ever.”

According to U.S. Treasury guidance, examples of uses for these funds include, but are not limited to, supporting the public health response to COVID-19, addressing negative economic impacts of COVID-19, improving water, sewer, and broadband infrastructure, paying premiums for essential workers, and replacing public sector revenue losses. Each non-entitlement community will make their own decisions in line with the Treasury guidance about how to spend these ARPA dollars. They have until 2024 to obligate the funds and until 2026 to spend the funds. These same local governments will receive a second payment, equal to the payment being announced today in 2022, bringing the total funding made available to over $411 million.

added 11/30/2021

Gov. Evers Announces More Than $200 Million for Wisconsin Communities Through ARPA State and Local Fiscal Recovery Funds

Funds ensure local communities can invest in unique needs toward ensuring economic recovery

MADISON — Gov. Tony Evers announced today that $205,769,426 has been directed to the 1,825 participating Wisconsin local governments under the American Rescue Plan Act’s (ARPA) State and Local Fiscal Recovery Funds (SLFRF) program.

“I am very pleased to report that so many of our local communities and governments are taking advantage of these federal funds to make improvements in their communities that they otherwise would not have had the funds to do,” said Gov. Evers. “From addressing the public health impacts of the pandemic to investing in needed critical infrastructure, to helping ensure families and businesses financially recover, these funds will allow local governments to invest in their community's unique needs and will make a major difference for Wisconsinites across our state.”

The funds were directed to cities, towns, and villages with a population of less than 50,000 in Wisconsin by the federal government under the ARPA SLFRF program. The amount allocated to each local government is based on a specific formula largely based on population.

“I'm very proud of the work of the DOR team and our partner organizations who worked tirelessly to answer questions from the local governments, thereby making the 99.99% success rate possible,” said Department of Revenue (DOR) Secretary Peter Barca. “Local leaders told us how vital their funds will be to their recovery and that of their local citizens.”

Under the SLFRF program, counties, large municipalities, and tribal governments received their own allocation from the federal government. Non-entitlement units, those under 50,000 in population, received their distribution from the state. The DOR, in conjunction with the Department of Administration (DOA), has been working to ensure that all Wisconsin non-entitlement units apply for and receive their share of these ARPA dollars. The state also worked closely with the Wisconsin Towns Association and the League of Wisconsin Municipalities to alert all 1,828 local governments of the opportunity for these ARPA dollars and assist them in creating plans to spend the dollars in accordance with U.S. Treasury guidance.

“The COVID-19 pandemic touched every corner of our state, and in many cases the ARPA SLFRF funds provided a much-needed lifeline to our communities,” said DOA Secretary Joel Brennan. “Thanks to the key partnerships which made this successful roll-out possible, we’re now able to see our local economies bounce back stronger than ever.”

According to U.S. Treasury guidance, examples of uses for these funds include, but are not limited to, supporting the public health response to COVID-19, addressing negative economic impacts of COVID-19, improving water, sewer, and broadband infrastructure, paying premiums for essential workers, and replacing public sector revenue losses. Each non-entitlement community will make their own decisions in line with the Treasury guidance about how to spend these ARPA dollars. They have until 2024 to obligate the funds and until 2026 to spend the funds. These same local governments will receive a second payment, equal to the payment being announced today in 2022, bringing the total funding made available to over $411 million.

added 11/30/2021

With input from national and state health and industry experts and in partnership with the Wisconsin Department of Health Services, the Wisconsin Department of Agriculture, Trade and Consumer Protection, the Wisconsin Department of Safety and Professional Services, the Wisconsin Department of Tourism and our regional economic development partners, WEDC has compiled a series of industry-specific documents to help you get back to business while taking the necessary precautions to maximize safety. Following these guidelines will help us all get Wisconsin’s economy back on track.

Small Business Administrations Restaurant Revitalization Fund-The American Rescue Plan Act established the Restaurant Revitalization Fund (RRF) to provide funding to help restaurants and other eligible businesses keep their doors open. This program will provide restaurants with funding equal to their pandemic-related revenue loss up to $10 million per business and no more than $5 million per physical location. Recipients are not required to repay the funding as long as funds are used for eligible uses no later than March 11, 2023.

added 12/2021

Economic Injury Disaster Loan and Advance (EIDL) Remain Available

The Economic Injury Disaster Loan (EIDL) is also open to small businesses, including sole-proprietors and single-member LLCs, and helps provide small businesses with working capital. The EIDL offers 3.75% interest rates for small businesses and offers the ability to spread payments over 30 years. Loans at or below $25,000 require no collateral. Loans are offered directly by the Small Business Administration and an application is available at https://covid19relief.sba.gov/#/.

Information regarding the EIDL program: https://wisconsinsbdc.org/services/covid-19/disasterloans/

If you have questions or need assistance to determine if these financial relief programs may apply to your business activities, please email us at [email protected] and request an opportunity to speak with one of our business counselors.

The Economic Injury Disaster Loan (EIDL) is also open to small businesses, including sole-proprietors and single-member LLCs, and helps provide small businesses with working capital. The EIDL offers 3.75% interest rates for small businesses and offers the ability to spread payments over 30 years. Loans at or below $25,000 require no collateral. Loans are offered directly by the Small Business Administration and an application is available at https://covid19relief.sba.gov/#/.

Information regarding the EIDL program: https://wisconsinsbdc.org/services/covid-19/disasterloans/

If you have questions or need assistance to determine if these financial relief programs may apply to your business activities, please email us at [email protected] and request an opportunity to speak with one of our business counselors.

Disaster Home and Business LoansExisting SBA disaster loans approved prior to 2020 in regular servicing status as of March 1, 2020, received an automatic deferment of principal and interest payments through December 31, 2020. This initial deferment period was subsequently extended through March 31, 2021. An additional 12-month deferment of principal and interest payments will be automatically granted to these borrowers. Borrowers will resume their regular payment schedule with the payment immediately preceding March 31, 2022, unless the borrower voluntarily continues to make payments while on deferment. It is important to note that the interest will continue to accrue on the outstanding balance of the loan throughout the duration of the deferment.

updated 12/2021

Visit the SBA website to see the 10 Steps to Starting your Business!!

https://www.sba.gov/business-guide/10-steps-start-your-business

https://www.sba.gov/business-guide/10-steps-start-your-business

Office of Native American Affairs

The U.S. Small Business Administration's (SBA) Office of Native American Affairs (ONAA) facilitates full access to business growth and expansion tools for small businesses owned by Native Americans. ONAA engages in tribal consultations, produces promotional materials, and participates in national economic development conferences.

American Indians, Alaska Natives, and Native Hawaiians can use our local assistance tool to find nearby offices and resources. There, you can get counseling on whether our 8(a) Business Development Program is right for you.

The U.S. Small Business Administration's (SBA) Office of Native American Affairs (ONAA) facilitates full access to business growth and expansion tools for small businesses owned by Native Americans. ONAA engages in tribal consultations, produces promotional materials, and participates in national economic development conferences.

American Indians, Alaska Natives, and Native Hawaiians can use our local assistance tool to find nearby offices and resources. There, you can get counseling on whether our 8(a) Business Development Program is right for you.

Added 12/2021

LGBTQ+ inclusion and outreachSBA's Network for LGBTQ+ Businesses aims to bring focus on economic empowerment in the LGBTQ+ business community by providing access to the U.S. Small Business Administration's programs and services.

Business owners can use our local assistance tool to find nearby offices and resources. There, you can get counseling on whether our 8(a) Business Development Program is right for you.

The SBA conducts outreach to be more inclusive of LGBTQ+ business owners, and our staff welcomes and recognizes the importance of greater inclusion at all levels and in all communities.

A number of District Offices have a strategic alliance with the LGBTQ+ business community

Business owners can use our local assistance tool to find nearby offices and resources. There, you can get counseling on whether our 8(a) Business Development Program is right for you.

The SBA conducts outreach to be more inclusive of LGBTQ+ business owners, and our staff welcomes and recognizes the importance of greater inclusion at all levels and in all communities.

A number of District Offices have a strategic alliance with the LGBTQ+ business community

Added 12/2021

Partnership with USDA- Rural America In April 2017, Former President Trump issued an Executive Order promoting agriculture and rural prosperity. In support of that effort, SBA signed a Memorandum of Understanding with the U.S. Department of Agriculture (USDA) that commits to a deeper collaboration and coordination of resources.

SBA is working to increase access to capital, improve opportunities for public and private investments in rural America, help rural businesses export products around the world, and increase the resiliency of rural communities through small business development. The effort aims to achieve the President’s vision of a rural America with world-class resources, and the tools and support necessary to build robust and sustainable communities.

SBA is working to increase access to capital, improve opportunities for public and private investments in rural America, help rural businesses export products around the world, and increase the resiliency of rural communities through small business development. The effort aims to achieve the President’s vision of a rural America with world-class resources, and the tools and support necessary to build robust and sustainable communities.

Added 5/14/20

On Wednesday May 13th, the Wisconsin Supreme Court voted to shut down the State’s Stay-at-Home Order, lifting most restrictions that were originally in effect until May 26th. The ruling immediately lifts all restrictions on businesses and gatherings imposed by the administration's order but keeps in place the closure of schools until fall.

This ruling has prompted several counties and communities, such as heavily-impacted areas like the City of Milwaukee, Brown County, and Dane County, to issue their own stay-at-home orders. Below we discuss steps that businesses should consider before reopening.

Steps for Businesses to Follow Before Reopening

In the aftermath of the Wisconsin Supreme Court’s ruling, which allows most businesses to reopen immediately, businesses should follow these steps to ensure they can provide a safe work environment for their employees and that they are following any local stay-at-home orders.

1. Review the WEDC’s Reopening Guidelines for Businesses:

It is important that businesses thoroughly review the WEDC‘s Reopening Guidelines before opening. These guidelines include a set of general guidelines for all businesses to follow, as well as a series of industry-specific documents to help you get back to business while taking the necessary precautions to maximize safety. Following these guidelines will help us all get Wisconsin’s economy back on track.

2. Check for Local Orders:

Several counties and communities are issuing their own stay-at-home orders. This means that there will soon be a mix of different stay-at-home orders, with varying ending-dates and restrictions, across the state. Before opening, businesses should check to see if their county or community has issued a stay-at-home order, and what restrictions that order might have. Please check your local county and municipality websites to see if they have issued a stay-at-home order.

3. The order is gone, the virus is not.

Continue to practice the guidance that has been developed over the last eight weeks. Maintain physical distance, avoid gathering in groups, use good personal hygiene, handwashing, etc. When you feel ill do not go to work, the store, or anywhere else. Consider wearing a cloth face covering when out in public. People who are vulnerable and at higher risk of severe complications of COVID-19 should stay home whenever possible. This includes people over the age of 65, people who live in nursing homes or long-term care facilities, and individuals with underlying health conditions. If you feel you have symptoms of COVID-19, contact your healthcare provider for testing options, or visit https://www.dhs.wisconsin.gov/testing for a list of community testing sites.

For more information go to:

Centers for Disease Control: https://www.cdc.gov/coronavirus/2019-ncov/prevent-getting-sick/prevention.html

OSHA RESOURCES: https://www.osha.gov/

WISCONSIN DEPARTMENT OF HEALTH SERVICES (DHS) COVID-19 RESOURCES: https://www.dhs.wisconsin.gov/covid-19

Copyright © 2020 North Central Wisconsin Regional Planning Commission, All rights reserved.

The North Central Wisconsin Regional Planning Commission COVID-19 Updates are sent to economic development professionals and communities within the North Central Wisconsin Region to get important resources and information in the hands of communities and businesses throughout the region.

Our mailing address is:

North Central Wisconsin Regional Planning Commission

210 McClellan St

Suite 210

Wausau, Wisconsin 54403

This ruling has prompted several counties and communities, such as heavily-impacted areas like the City of Milwaukee, Brown County, and Dane County, to issue their own stay-at-home orders. Below we discuss steps that businesses should consider before reopening.

Steps for Businesses to Follow Before Reopening

In the aftermath of the Wisconsin Supreme Court’s ruling, which allows most businesses to reopen immediately, businesses should follow these steps to ensure they can provide a safe work environment for their employees and that they are following any local stay-at-home orders.

1. Review the WEDC’s Reopening Guidelines for Businesses:

It is important that businesses thoroughly review the WEDC‘s Reopening Guidelines before opening. These guidelines include a set of general guidelines for all businesses to follow, as well as a series of industry-specific documents to help you get back to business while taking the necessary precautions to maximize safety. Following these guidelines will help us all get Wisconsin’s economy back on track.

2. Check for Local Orders:

Several counties and communities are issuing their own stay-at-home orders. This means that there will soon be a mix of different stay-at-home orders, with varying ending-dates and restrictions, across the state. Before opening, businesses should check to see if their county or community has issued a stay-at-home order, and what restrictions that order might have. Please check your local county and municipality websites to see if they have issued a stay-at-home order.

3. The order is gone, the virus is not.

Continue to practice the guidance that has been developed over the last eight weeks. Maintain physical distance, avoid gathering in groups, use good personal hygiene, handwashing, etc. When you feel ill do not go to work, the store, or anywhere else. Consider wearing a cloth face covering when out in public. People who are vulnerable and at higher risk of severe complications of COVID-19 should stay home whenever possible. This includes people over the age of 65, people who live in nursing homes or long-term care facilities, and individuals with underlying health conditions. If you feel you have symptoms of COVID-19, contact your healthcare provider for testing options, or visit https://www.dhs.wisconsin.gov/testing for a list of community testing sites.

For more information go to:

Centers for Disease Control: https://www.cdc.gov/coronavirus/2019-ncov/prevent-getting-sick/prevention.html

OSHA RESOURCES: https://www.osha.gov/

WISCONSIN DEPARTMENT OF HEALTH SERVICES (DHS) COVID-19 RESOURCES: https://www.dhs.wisconsin.gov/covid-19

Copyright © 2020 North Central Wisconsin Regional Planning Commission, All rights reserved.

The North Central Wisconsin Regional Planning Commission COVID-19 Updates are sent to economic development professionals and communities within the North Central Wisconsin Region to get important resources and information in the hands of communities and businesses throughout the region.

Our mailing address is:

North Central Wisconsin Regional Planning Commission

210 McClellan St

Suite 210

Wausau, Wisconsin 54403

FOR IMMEDIATE RELEASE: May 11, 2020

Contact: [email protected] or 608-219-7443

Gov. Evers Announces Another Turn of the Dial for Wisconsin Businesses

MADISON — Gov. Tony Evers today announced another turn of the dial on Safer at Home to add even more opportunities for Wisconsin businesses to get back to work in a safe and responsible way.

Emergency Order #36, signed today by Wisconsin Department of Health Services (DHS) Secretary-designee Andrea Palm, allows all standalone or strip-mall based retail stores to offer in-person shopping for up to five customers at a time while maintaining required social distancing practices. Additionally, the Emergency Order signed today allows drive-in theaters to operate with some restrictions. All businesses must continue to follow all safety precautions and guidelines as outlined in the Safer at Home order.

"In addition to added flexibilities and steps we have already taken for businesses, this is another disciplined turn of the dial that will allow Wisconsin's business owners to safely get back to work and Wisconsin consumers to support their favorite local spots," said Gov. Evers. "Both customers and workers need to be confident in their safety, so we need everyone to be diligent in following best safety practices so we can continue to move our state forward while keeping our neighbors, families, and communities safe and healthy."

Today’s order builds upon the Safer at Home order and the last turn of the dial through Emergency Order #34, which together allowed golf courses to operate, aesthetic and optional lawn and construction services provided by a single employee, curbside pick-up for public libraries, and every business to provide deliveries, mailings, and curbside pick-up and drop-off services.

Emergency Order #36 is available here and goes into effect immediately. If you have questions regarding Emergency Order #36, please review the frequently asked questions document available here.

In addition to the requirements outlined above, all essential and nonessential businesses must review and consider the Wisconsin Department of Economic Development guidelines on safe business practices, available here.

Contact: [email protected] or 608-219-7443

Gov. Evers Announces Another Turn of the Dial for Wisconsin Businesses

MADISON — Gov. Tony Evers today announced another turn of the dial on Safer at Home to add even more opportunities for Wisconsin businesses to get back to work in a safe and responsible way.

Emergency Order #36, signed today by Wisconsin Department of Health Services (DHS) Secretary-designee Andrea Palm, allows all standalone or strip-mall based retail stores to offer in-person shopping for up to five customers at a time while maintaining required social distancing practices. Additionally, the Emergency Order signed today allows drive-in theaters to operate with some restrictions. All businesses must continue to follow all safety precautions and guidelines as outlined in the Safer at Home order.

"In addition to added flexibilities and steps we have already taken for businesses, this is another disciplined turn of the dial that will allow Wisconsin's business owners to safely get back to work and Wisconsin consumers to support their favorite local spots," said Gov. Evers. "Both customers and workers need to be confident in their safety, so we need everyone to be diligent in following best safety practices so we can continue to move our state forward while keeping our neighbors, families, and communities safe and healthy."

Today’s order builds upon the Safer at Home order and the last turn of the dial through Emergency Order #34, which together allowed golf courses to operate, aesthetic and optional lawn and construction services provided by a single employee, curbside pick-up for public libraries, and every business to provide deliveries, mailings, and curbside pick-up and drop-off services.

Emergency Order #36 is available here and goes into effect immediately. If you have questions regarding Emergency Order #36, please review the frequently asked questions document available here.

In addition to the requirements outlined above, all essential and nonessential businesses must review and consider the Wisconsin Department of Economic Development guidelines on safe business practices, available here.

added 5/11/20

COVID Tax Tip 2020-53, May 7, 2020

Small and midsize employers can claim two new refundable payroll tax credits. The paid sick leave credit and the paid family leave credit are designed to immediately and fully reimburse eligible employers for the cost of providing COVID-19 related leave to their employees.

Here are some key things to know about these credits.

Paid sick and family leave

For COVID-19 related reasons, employees receive up to 80 hours of paid sick leave when they are sick or caring for someone else who is, and up to 10 weeks of paid family leave when their children's schools or place of care are closed, or child care providers are unavailable due to COVID-19.

Coverage

For details about these credits and other relief, visit Coronavirus Tax Relief on IRS.gov.

Related news coverage: https://www.thinkadvisor.com/2020/05/07/irs-reminds-employers-of-3-covid-19-tax-credits/

Some employers can use tax credits for employee retention, paid sick leave and family leave if they've been affected by the coronavirus pandemic, according to the IRS. This article explains eligibility, reporting and calculation.

Andrew Nussbaum

Regional Tourism Specialist

Wisconsin Department of Tourism

PO Box 803

Beaver Dam, WI 53916

(715) 299-5422

Industry.Travelwisconsin.com

Small and midsize employers can claim two new refundable payroll tax credits. The paid sick leave credit and the paid family leave credit are designed to immediately and fully reimburse eligible employers for the cost of providing COVID-19 related leave to their employees.

Here are some key things to know about these credits.

Paid sick and family leave

For COVID-19 related reasons, employees receive up to 80 hours of paid sick leave when they are sick or caring for someone else who is, and up to 10 weeks of paid family leave when their children's schools or place of care are closed, or child care providers are unavailable due to COVID-19.

Coverage

- Employers receive 100% reimbursement for required paid leave.

- Health insurance costs are also included in the credit.

- Employers do not owe their share of social security tax on the paid leave and get a credit for their share of Medicare tax on the paid leave.

- Self-employed individuals receive an equivalent credit.

- Reimbursement will be quick and easy.

- The credit provides a dollar-for-dollar tax offset against the employer's payroll taxes

- The IRS will send any refunds owed as quickly as possible.

For details about these credits and other relief, visit Coronavirus Tax Relief on IRS.gov.

Related news coverage: https://www.thinkadvisor.com/2020/05/07/irs-reminds-employers-of-3-covid-19-tax-credits/

Some employers can use tax credits for employee retention, paid sick leave and family leave if they've been affected by the coronavirus pandemic, according to the IRS. This article explains eligibility, reporting and calculation.

Andrew Nussbaum

Regional Tourism Specialist

Wisconsin Department of Tourism

PO Box 803

Beaver Dam, WI 53916

(715) 299-5422

Industry.Travelwisconsin.com

5/11/20

Reopening Guidelines:

The guides were developed by the Wisconsin Economic Development Corporation (WEDC) in consultation with the Departments of Health Services, Agriculture, Trade and Consumer Protection and Tourism, as well as and industry experts and associations. https://wedc.org/reopen-guidelines/

The guides were developed by the Wisconsin Economic Development Corporation (WEDC) in consultation with the Departments of Health Services, Agriculture, Trade and Consumer Protection and Tourism, as well as and industry experts and associations. https://wedc.org/reopen-guidelines/

Added 5/11/20

CDC Guidance for Cleaning & Disinfecting

|

| ||||||||||||

Added 5/5/20

See OSHAs Guidance on Preparing Workplaces for COVID-19 here

US Travel Association’s collaboration with medical experts has been a critical component to the development of this travel industry guidance. Expertise in Infectious diseases, preventative and occupational medicine led to the various facets of the travel experience being viewed through a lens of how best to minimize the spread of COVID-19. Using a layered approach to health and safety, the guidance reinforces various combined measures such as employee and traveler physical distancing, hand hygiene, personal protective equipment (PPE) and behaviors before and during the travel continuum. As this guidance adapts and evolves, the travel industry will continue to seek the input from trusted medical sources to reflect the latest developments within and guidance from the professional health community. You can see and downoad the document here:

| travelhealthandsafetyguidance[1765].pdf | |

| File Size: | 6260 kb |

| File Type: | |

Added 5/5/20

|

added 5/5/20

|

Join marketing expert and Amazon best-selling author, Tom Ray, on Thursday, May 14th at 2pm Central for this special webinar.

Tom will discuss best practices for local advertisers during these challenging conditions, including:

REGISTER for this event: Survival Strategies (After registering, you'll receive a confirmation email from Tom Ray with participation instructions.) Sincerely, Sue Wake South Central Wisconsin Business Development Specialist 5727 Tokay Blvd. Madison, WI 53719 [email protected] 608-212-6210 |

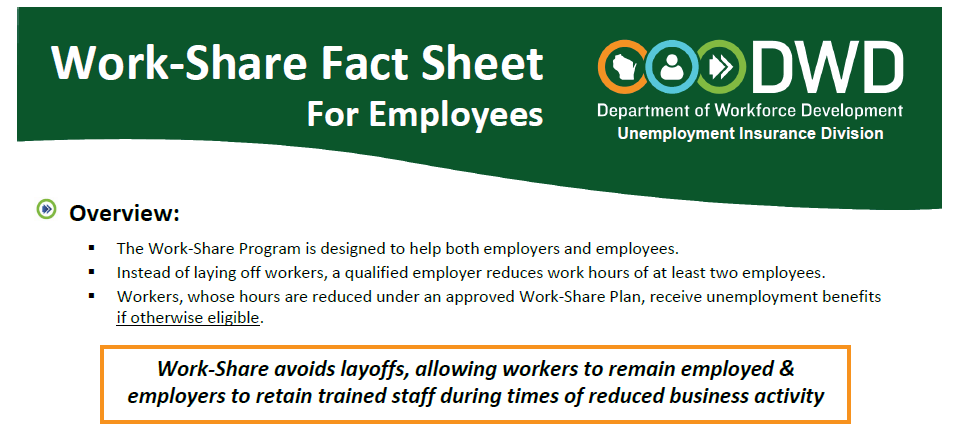

The Department of Workforce Development (DWD) is encouraging Wisconsin employers to consider Wisconsin's updated Work-Share Program to avoid worker layoffs.

The Work-Share Program, also called "short-term compensation" (STC), is designed to help both employers and employees. Instead of laying off workers, a participating employer may reduce their work hours. Workers whose hours are reduced under an approved work-share plan receive unemployment benefits that are pro-rated for the partial work reduction. This allows everyone in the work unit to maintain some income and their health benefits.

For more information on the Work-Share Program and how to apply, please visit https://dwd.wisconsin.gov/uitax/workshare.htm.

The Work-Share Program, also called "short-term compensation" (STC), is designed to help both employers and employees. Instead of laying off workers, a participating employer may reduce their work hours. Workers whose hours are reduced under an approved work-share plan receive unemployment benefits that are pro-rated for the partial work reduction. This allows everyone in the work unit to maintain some income and their health benefits.

For more information on the Work-Share Program and how to apply, please visit https://dwd.wisconsin.gov/uitax/workshare.htm.

Order number 34 - opening more "non essential" businesses including rental of recreational equipment, animal services, and car washes, within restrictions

added 4/28/20

The Save Small Business Fund is a grantmaking initiative offering short-term relief for small employers in the United States and its territories. This is an initiative of the U.S. Chamber of Commerce Foundation.

A short application will go live on this page today, on April 20, 2020: https://savesmallbusiness.com/

To apply, you must run a small business or chamber of commerce with between 3-20 employees (including yourself and not including independent contractors). The business must be located in an economically vulnerable community. This is defined as the bottom 80% of the most economically distressed zip codes in the United States, as ranked by the Distressed Communities Index. Before starting the application, you will be asked for the zip code where you are registered by the IRS as doing business, which will confirm your eligibility.

A short application will go live on this page today, on April 20, 2020: https://savesmallbusiness.com/

To apply, you must run a small business or chamber of commerce with between 3-20 employees (including yourself and not including independent contractors). The business must be located in an economically vulnerable community. This is defined as the bottom 80% of the most economically distressed zip codes in the United States, as ranked by the Distressed Communities Index. Before starting the application, you will be asked for the zip code where you are registered by the IRS as doing business, which will confirm your eligibility.

added 4/20/20

FOR IMMEDIATE RELEASE: April 20, 2020

Contact: [email protected] or 608-219-7443

Gov. Evers Announces Badger Bounce Back Plan

MADISON — Gov. Tony Evers today announced Wisconsin's "Badger Bounce Back" plan which outlines important criteria for Wisconsin to be able to reopen its economy in phases and includes steps to make sure workers and businesses are prepared to reopen as soon as it is safe to do so. In coordination with this announcement, at the direction of the governor, Wisconsin Department of Health Services Secretary-designee Andrea Palm issued Emergency Order #31 establishing the process and outlining the phases of the plan. The emergency order is available here.

“As we've learned over the past month, in the most difficult of circumstances, Wisconsinites will rise to the occasion, helping each other and working together to do what's best for our families, our neighbors, and our communities,” said Gov. Evers. “That's what the Badger Bounce Back is all about: our resilience as a people and as a state. I am excited and hopeful about this plan. While being safe at home continues to be important, this plan is an all-out attack on the virus and it begins the process of preparing our businesses and our workforce for the important planning that will result in the safe and logical reopening of our economy.”

The Badger Bounce Back plan is informed in part by the President's Guidelines for Opening Up America Again that was issued by the White House on April 16, 2020. Currently, Wisconsin does not meet the criteria the White House established to start reopening our state. The Badger Bounce Back plan takes important steps to get the state of Wisconsin there.

The goal of the Badger Bounce Back plan is to decrease cases and deaths to a low level, and increase capacity in our healthcare system so the phased reopening of businesses is possible. As part of that plan the state will be working to increase access to more testing and expand lab capacity. Under the Badger Bounce Back plan, everyone who needs a test should get a test. The state is setting a goal of 85,000 tests per week, averaging about 12,000 tests per day. More information on the state's testing efforts was released earlier today, and is available for review here.

Next, the state will be expanding contact tracing and more aggressively tracking the spread with the goal of every Wisconsinite who tests positive being interviewed within 24 hours of receiving their test results and their contacts being interviewed within 48 hours of test results.

Additionally, the state will continue to pursue every avenue to grow Wisconsin’s supply of personal protective equipment (PPE) for healthcare and public safety entities to conduct COVID-19 testing, patient care, and public safety work. Finally, the plan works to bolster healthcare system capacity where patients can be treated without crisis care and there are more robust testing programs in place for at-risk healthcare workers.

The state will be looking for a downward trajectory of influenza-like illnesses and COVID-19 symptoms reported within a 14-day period, and a downward trajectory of positive tests as a percent of total tests within a 14-day period. When the state has seen these efforts be successful, Wisconsin can begin to turn the dial, re-open the state, and get businesses and workers back on their feet.

The Badger Bounce Back plan is available here. The Wisconsin Economic Development Corporation’s portion of the Badger Bounce Back plan aimed at helping to ensure workers and businesses are prepared and ready to bounce back is available here. The Badger Bounce Back plan in brief is also available here

Contact: [email protected] or 608-219-7443

Gov. Evers Announces Badger Bounce Back Plan

MADISON — Gov. Tony Evers today announced Wisconsin's "Badger Bounce Back" plan which outlines important criteria for Wisconsin to be able to reopen its economy in phases and includes steps to make sure workers and businesses are prepared to reopen as soon as it is safe to do so. In coordination with this announcement, at the direction of the governor, Wisconsin Department of Health Services Secretary-designee Andrea Palm issued Emergency Order #31 establishing the process and outlining the phases of the plan. The emergency order is available here.

“As we've learned over the past month, in the most difficult of circumstances, Wisconsinites will rise to the occasion, helping each other and working together to do what's best for our families, our neighbors, and our communities,” said Gov. Evers. “That's what the Badger Bounce Back is all about: our resilience as a people and as a state. I am excited and hopeful about this plan. While being safe at home continues to be important, this plan is an all-out attack on the virus and it begins the process of preparing our businesses and our workforce for the important planning that will result in the safe and logical reopening of our economy.”

The Badger Bounce Back plan is informed in part by the President's Guidelines for Opening Up America Again that was issued by the White House on April 16, 2020. Currently, Wisconsin does not meet the criteria the White House established to start reopening our state. The Badger Bounce Back plan takes important steps to get the state of Wisconsin there.

The goal of the Badger Bounce Back plan is to decrease cases and deaths to a low level, and increase capacity in our healthcare system so the phased reopening of businesses is possible. As part of that plan the state will be working to increase access to more testing and expand lab capacity. Under the Badger Bounce Back plan, everyone who needs a test should get a test. The state is setting a goal of 85,000 tests per week, averaging about 12,000 tests per day. More information on the state's testing efforts was released earlier today, and is available for review here.

Next, the state will be expanding contact tracing and more aggressively tracking the spread with the goal of every Wisconsinite who tests positive being interviewed within 24 hours of receiving their test results and their contacts being interviewed within 48 hours of test results.

Additionally, the state will continue to pursue every avenue to grow Wisconsin’s supply of personal protective equipment (PPE) for healthcare and public safety entities to conduct COVID-19 testing, patient care, and public safety work. Finally, the plan works to bolster healthcare system capacity where patients can be treated without crisis care and there are more robust testing programs in place for at-risk healthcare workers.

The state will be looking for a downward trajectory of influenza-like illnesses and COVID-19 symptoms reported within a 14-day period, and a downward trajectory of positive tests as a percent of total tests within a 14-day period. When the state has seen these efforts be successful, Wisconsin can begin to turn the dial, re-open the state, and get businesses and workers back on their feet.

The Badger Bounce Back plan is available here. The Wisconsin Economic Development Corporation’s portion of the Badger Bounce Back plan aimed at helping to ensure workers and businesses are prepared and ready to bounce back is available here. The Badger Bounce Back plan in brief is also available here

Added April 20, 2020

Here are links that answer a few top questions:

I’m now out of work, where do I apply for unemployment online?

Are there still waiting periods?

• The Wisconsin Department of Workforce Development - Frequently Asked Questions: https://dwd.wisconsin.gov/uiben/faqs/

I need business help .. now

• WEDC COVID-19 Resources Page: https://wedc.org/programs-and-resources/covid-19-response/

And SBA https://www.sba.gov/funding-programs/disaster-assistance

When is the IRS sending me the economic impact payment?

• Internal Revenue Service: Information on Economic Impact Payments: https://www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know

What is COVID-19 anyway?

• Centers for Disease Control - Frequently Asked Questions: https://www.cdc.gov/coronavirus/2019-ncov/faq.html

What are the symptoms?

Should we wear masks everywhere?

How many people in WI actually have it?

• The Wisconsin Department of Health Services - COVID-19 Web Page: https://www.dhs.wisconsin.gov/covid-19/index.htm

When is a worker eligible for paid sick leave under FFCRA to self-quarantine?

A worker is eligible for paid sick leave under the FFCRA if a health care provider directs or advises them to stay home or otherwise quarantine because the health care provider believes that they may have COVID-19 or are particularly vulnerable to COVID-19, and quarantining based upon that advice prevents them from working (or teleworking).

I’m now out of work, where do I apply for unemployment online?

Are there still waiting periods?

• The Wisconsin Department of Workforce Development - Frequently Asked Questions: https://dwd.wisconsin.gov/uiben/faqs/

I need business help .. now

• WEDC COVID-19 Resources Page: https://wedc.org/programs-and-resources/covid-19-response/

And SBA https://www.sba.gov/funding-programs/disaster-assistance

When is the IRS sending me the economic impact payment?

• Internal Revenue Service: Information on Economic Impact Payments: https://www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know

What is COVID-19 anyway?

• Centers for Disease Control - Frequently Asked Questions: https://www.cdc.gov/coronavirus/2019-ncov/faq.html

What are the symptoms?

Should we wear masks everywhere?

How many people in WI actually have it?

• The Wisconsin Department of Health Services - COVID-19 Web Page: https://www.dhs.wisconsin.gov/covid-19/index.htm

When is a worker eligible for paid sick leave under FFCRA to self-quarantine?

A worker is eligible for paid sick leave under the FFCRA if a health care provider directs or advises them to stay home or otherwise quarantine because the health care provider believes that they may have COVID-19 or are particularly vulnerable to COVID-19, and quarantining based upon that advice prevents them from working (or teleworking).

added 4/6/20

View these resource packets to help you navigate through these programs - click the button to view the file

Thank you Tabitha Lueneburg, AFLAC BENEFITS COORDINATOR at Greater Insurance Service for these files. If you would like to contact Tabitha, you can reach her at:

Tabitha Lueneburg

AFLAC BENEFITS COORDINATOR

Greater Insurance Service

CELL: 608-393-6552 Phone: 800-747-4472 Fax: 608-221-0868 email: [email protected]

Tabitha Lueneburg

AFLAC BENEFITS COORDINATOR

Greater Insurance Service

CELL: 608-393-6552 Phone: 800-747-4472 Fax: 608-221-0868 email: [email protected]

Hello! This is a request for GOOD NEWS!

Travel Wisconsin is building a collection of virtual experience and tours to promote through our social, PR and other marketing channels.

Please feel free to share any virtual experiences and I will add them to the list.

Thank you for any supplying any extra opportunities to promote your destinations!

Andrew Nussbaum

Regional Tourism Specialist

Wisconsin Department of Tourism

PO Box 803

Beaver Dam, WI 53916

(715) 299-5422

Industry.Travelwisconsin.com

Email your videos to Adrew Nussbaum at [email protected]

Travel Wisconsin is building a collection of virtual experience and tours to promote through our social, PR and other marketing channels.

Please feel free to share any virtual experiences and I will add them to the list.

Thank you for any supplying any extra opportunities to promote your destinations!

Andrew Nussbaum

Regional Tourism Specialist

Wisconsin Department of Tourism

PO Box 803

Beaver Dam, WI 53916

(715) 299-5422

Industry.Travelwisconsin.com

Email your videos to Adrew Nussbaum at [email protected]

Added 4/8/20

Thank you to the Wisconsin Manufactures & Commerce and Wisconsin Safety Council this list of

Best Practices;

As some businesses remain open and running, WMC and Wisconsin Safety Council want to remind you of best practices to keep your employees & business safe and healthy during the COVID-19 crisis. Please see the following best practices:

Best Practices;

As some businesses remain open and running, WMC and Wisconsin Safety Council want to remind you of best practices to keep your employees & business safe and healthy during the COVID-19 crisis. Please see the following best practices:

- Ban in-person meetings (internal or external) and employee convenings (formal or informal) of any size. Employee communication handled virtually wherever possible.

- Employees scanned regularly on-site for body temperature (contingent on availability of scanning devices, which are in short supply due to acute global demand).

- Immediate workflow audit that removes instances of employees being within 6’ of each other.

- Reduction of on-site work hours to minimum needed to sustain operations.

- Staggered shifts and work hours to minimize on-site human presence at a given time.

- Staggered use of all shared spaces, including bathrooms, breakrooms and lunchrooms.

- Staggered facility entry and exit procedures.

- Mandatory work at home for all employees except those necessary for baseline production and logistics functions.

- Sanitary processes implemented throughout facility (soap, hand sanitizer, single-use gloves, doors propped open, hands-free capabilities, no shared food).

- Blue tape marking of surfaces that receive frequent human contact; disinfection of these surfaces multiple times daily.

- International travel ban – business and personal.

- Domestic business travel ban except for critical operations (with senior management approval). Domestic personal travel requires employee to self-quarantine for 14 days and be symptom-free before returning to work.

- Any employee returning from a Level 2 or 3 CDC travel country must self-quarantine for 14 days and be symptom-free before returning to work.

- No deliveries except those that support production activities or emergency building maintenance.

- No visitors (including suppliers and customers) except those approved by senior management.

- Employees must immediately report symptoms associated with COVID-19 exposure.

- Employees must report contact with any person who tests positive for COVID-19; employee must subsequently self-quarantine for 14 days and be symptom-free before returning to work.

added 4/7/20

President Trump—joined by SBA Administrator Jovita Carranza, Treasury Secretary Steven Mnuchin, and other members of the Coronavirus Task Force—announced details of the $350 billion Paycheck Protection Program to assist small businesses in keeping their workforce employed during the COVID-19 epidemic. Specifically, the Paycheck Protection Program:

President Trump invoked the Defense Production Act to increase the number of N95 masks produced by 3M. The President separately issued a memorandum to expand production of ventilators by several other companies. The President also issued major disaster declarations for the Commonwealth of the Northern Mariana Islands, Virginia, U.S. Virgin Islands, and Tennessee.

- Provides nearly $350 billion in loans to small businesses.

- Certain non-profits, self-employed individuals, and independent contractors are also eligible for these loans.

- Small businesses can qualify for a loan of up to $10 million, based on their payroll expenses.

- If an employer maintains their workforce, the SBA will forgive the portion of the loan used to cover the first 8 weeks of payroll and certain other expenses.

- The Administration is working with banks so small businesses will be able to go directly to their local lenders to access these loans.

- Offers enhanced Economic Injury Disaster Loans for businesses that are facing a loss of revenue as a result of the coronavirus.

- SBA’s Economic Injury Disaster Loans can provide up to $2 million in long-term, low-interest loans to help small businesses overcome a loss of revenue due to the coronavirus.

- Small businesses are eligible to apply for an advance of up to $10,000, providing rapid assistance to help them cover critical expenses.

- SBA has streamlined the application process for these loans to make it easier for small businesses.

- Allows small businesses to still receive financial relief through the SBA’s traditional loan programs.

- Small businesses can access SBA’s 7(a) loan program, which provides loans of up to $5 million to cover eligible expenses.

- SBA’s express loan program offers qualified loans up to $350,000.

- Through the SBA’s Community Advantage loan pilot program, mission-based lenders can assist small businesses in underserved markets with loans of up to $250,000.

- The SBA provides export loans to help small businesses achieve sales and respond to challenges such as the coronavirus that impact trade.

President Trump invoked the Defense Production Act to increase the number of N95 masks produced by 3M. The President separately issued a memorandum to expand production of ventilators by several other companies. The President also issued major disaster declarations for the Commonwealth of the Northern Mariana Islands, Virginia, U.S. Virgin Islands, and Tennessee.

Added 4/6/20

State-wide COVID-19 Pandemic Economic Loss SurveyYou will note this survey tool is dated and stamped with Observation Period #1. After your survey completion you will get a second survey stamped Observation Period #2 the week of May 3rd directly from UW-Oshkosh Center for Customized Research & Services, in which the questions may be altered slightly.

We realize there likely will be overlap distribution - meaning you may get the survey from more than one organization. You only need to complete the survey once per observation period. Duplicates will be screened as part of the intake process. While there are a lot of unknowns during this time it is the intention that there will be a couple more observation period surveys through the tail end of the pandemic. Please don’t hesitate to contact us should you have any questions. LINK TO THE SURVEY uwo.sh/covid-19-econ-disruption Thank you and stay well! Updated 4/8/20, Added 4/2/20 UWL SBDC and LADCO OFFER BUSINESS WEBINAR

COVID-19: Supporting Small Business – Business Strategies and Financial Relief Access this interactive webinar and one-on-one consulting support for your business so you can more effectively understand available resources and develop a business and financial strategy in response to COVID-19. Webinar Dates: April 2, 3, 6, 7, 8, 9 (depending on demand, additional sessions will be made available) This webinar is scheduled to repeat at various times – sign up for one session. To register: CLICK HERE The Wisconsin Small Business Development Center at UW-La Crosse (SBDC) and the La Crosse Area Development Corporation (LADCO) are launching an interactive webinar COVID-19: Supporting Small Business – Business Strategies and Financial Relief with sessions starting April 2, 2020. This FREE workshop is an interactive opportunity for small business owners to gain the insight needed to develop a strategy to address business challenges due to the COVID-19 pandemic. The webinar will address various forms of financial relief available to small businesses. Webinar participants will be able to access the SBDC's FREE consulting services to assist them in defining a business strategy and how to identify and seek the financial support needed to proceed. LADCO also will be available to assist small businesses connect with state, county, and municipal staff and resources. This webinar and consulting support are FREE but registration is required. The webinar will be repeated numerous times so interested persons should only sign up for one session. To register: CLICK HERE For additional information about this event, visit www.uwlax.edu/sbdc or email [email protected]. The SBDC is funded in part through a Cooperative Agreement with the U.S. Small Business Administration. Reasonable accommodations for persons with disabilities will be made if requested at least two weeks in advance or as otherwise may be arranged. For further information about the UWL SBDC, visit its website at www.uwlax.edu/sbdc. For further information about LADCO, please visit its website at www.ladoclax.com. Added 4/2/20 |

Of all the financial assistance available to date I'm told the best place to start is with the SBA EIDL. When you apply, if qualified (not necessarily approved) you can get up to $10K VERY QUICKLY for your business operations (rent, mortgage, utilities, payroll, etc). And this $10K will be forgiven - so its like a grant - no repayment necessary - even if your EIDL loan app is not approved, you still don't have to repay the $10K. And it does not disqualify you from additional financial assistance programs (like the Payroll Protection Plan, or any programs still coming down the pipeline).

Here is the portal to get started: SBA Economic Injury Disaster Loan https://covid19relief.sba.gov/#/ We continue to update our website daily with additional resources and news as they come available http://www.juneaucounty.com/coronavirus-updates--resources.html Be Well and Stay Safe! One day at a time, we WILL get through this. Tamaya Loewe, Assistant Director Juneau County Economic Development Corp Office (608) 427-2070 Email [email protected] 122 Main Street PO Box 322 Camp Douglas WI 54618 USA added 4/2/20 Hello,

You may have heard that the Governor signed an executive order that changes some of the work permit requirements during the state of emergency. This email is to bring you up to speed on the changes, so that you can communicate them to people contacting you for assistance. Please keep in mind that these changes are all temporary and we will return to our prior practices after the state of emergency is lifted. The Executive Order does the following:

If you have any questions about any of this, please don't hesitate to contact us by phone or by email. Sincerely, Matthew White Director, Bureau of Investigations Equal Rights Division Department of Workforce Development Fax: 608-267-4592 Pronouns: he/him/his Added 4/2/20 WMC Business Coalition | COVID-19 Webinar | Industry Updates

Wisconsin Manufacturers & Commerce (WMC) hosted a business coalition update call that featured state updates from industry leaders including Scott Suder, Wisconsin Paper Council President, and Scott VanderSanden, AT&T President - Plains States. Added 4/6/20 |

CARES Act Webinar

U.S. Travel hosted a webinar earlier today to walk our members through the provisions of the CARES Act for which travel industry companies are eligible. Please see helpful resources below—all of which are also available on our CARES Act resources page—to ensure as many travel companies as possible are equipped to take advantage of the assistance available and provide guidance on how to navigate the recently passed relief package.

Please feel free to re-distribute and share all the resources through your networks.

In the webinar, U.S. Travel's government relations team shared detailed information about the following CARES Act provisions, including who is eligible, what kind of financial assistance is provided and how companies can apply, as well as any outstanding questions or direction still to come from the administration:

U.S. Travel's CARES Act page has a host of other resources as well, most notably a Guide to CARES Act Eligibility that can walk you through exactly what your organization is eligible for:

ELIGIBILITY GUIDE

Our page also includes other official resources from the Small Business Administration, House Small Business Committee, U.S. Department of Labor and Department of Homeland Security, among other materials.

Please feel free to continue to submit your specific questions about the CARES Act here—we will do our best to answer all of them and continue to do everything we can to get our industry the assistance it needs.

Please stay healthy,

Tori Emerson Barnes

Executive Vice President, Public Affairs and Policy

U.S. Travel Association

U.S. Travel hosted a webinar earlier today to walk our members through the provisions of the CARES Act for which travel industry companies are eligible. Please see helpful resources below—all of which are also available on our CARES Act resources page—to ensure as many travel companies as possible are equipped to take advantage of the assistance available and provide guidance on how to navigate the recently passed relief package.

Please feel free to re-distribute and share all the resources through your networks.

- View the full slide deck outlining CARES Act provisions and eligibility (PowerPoint slides available upon request)

- View an FAQ that answers many of your questions from today. We will continue to add to this page, which will be available with other resources.

- For the full recording with slides and audio, click below.

In the webinar, U.S. Travel's government relations team shared detailed information about the following CARES Act provisions, including who is eligible, what kind of financial assistance is provided and how companies can apply, as well as any outstanding questions or direction still to come from the administration:

- Emergency Stabilization Fund

- SBA Coronavirus Economic Injury Disaster Loans

- SBA Business Interruption Loans (Paycheck Protection Program)

- SBA Express Loans

- Debt Relief for Small Businesses

- Tax Relief

- Federal Grants for Airports & Community Development Block Grants

U.S. Travel's CARES Act page has a host of other resources as well, most notably a Guide to CARES Act Eligibility that can walk you through exactly what your organization is eligible for:

ELIGIBILITY GUIDE

Our page also includes other official resources from the Small Business Administration, House Small Business Committee, U.S. Department of Labor and Department of Homeland Security, among other materials.

Please feel free to continue to submit your specific questions about the CARES Act here—we will do our best to answer all of them and continue to do everything we can to get our industry the assistance it needs.

Please stay healthy,

Tori Emerson Barnes

Executive Vice President, Public Affairs and Policy

U.S. Travel Association

added 3/31/20

|

SMALL BUSINESS GUIDE FOR EMERGENCY LOANS

The Coronavirus Aid, Relief, and Economic Security (CARES) Act allocated $350 billion to help small businesses keep workers employed amid the pandemic and economic downturn. Known as the Paycheck Protection Program, the initiative provides 100% federally guaranteed loans to small businesses who maintain their payroll during this emergency. Importantly, these loans may be forgiven if borrowers maintain their payrolls during the crisis or restore their payrolls afterward. The administration soon will release more details including the list of lenders offering loans under the program. In the meantime, the U.S. Chamber of Commerce has issued this guide to help small businesses and self-employed individuals prepare to file for a loan (below).

added 3/30/20 WMC COVID-19 Update: U.S. Rep. Mike Gallagher & Industry Reports Wisconsin Manufacturers & Commerce (WMC), its trade association partners and local chambers had a business coalition update call with U.S. Rep. Mike Gallagher. The call detailed the federal government's legislation in response to the COVID-19 pandemic and updated listeners on how the business community is being impacted. The call also featured updates from numerous industry-specific trade associations. Added 3/30/20 Gov. Evers Issues Order to Expedite Expansion, Enhance Efficiency of Healthcare Workforce Yesterday, as part of WMC’s legislative agenda in response to the COVID-19 crisis, we called on the Governor and lawmakers to provide flexible licensing for health care workers. Specifically, we asked for flexibility for retired health care workers and to allow health care workers licensed in other states to practice in Wisconsin. Today, the Department of Health Services did just that through Emergency Order 16. You can see the full order here. Added 3/30/20 Trump signs $2T coronavirus relief package President Trump on Friday signed a $2 trillion economic relief package aimed at helping American workers and businesses impacted by the coronavirus pandemic. The bill includes $1,200 one-time payments to many Americans; sets up a $500 billion corporate liquidity fund to help struggling industries like airlines; allocated $377 billion for aid to small businesses; and boosts the maximum unemployment benefit by $600 per week for four months, among other provisions. Trump signed the legislation during an Oval Office ceremony at the White House Friday afternoon, just hours after it passed the House. The massive bill, dubbed the CARES Act, was the result of days of high-stakes negotiations between the Trump administration and Senate leaders. Click here for more information. Added 3/30/20 Common Questions Answered: “Is the new sick leave benefit only for COVID-19 related quarantine and diagnosis? Can an employee claim the paid leave for other illnesses during this time or for calling in sick for only 1 day?” The new sick leave under the FFCRA is only for COVID-19 related illnesses and situations. If an employee calls in because of COVID-19 symptoms or a potential diagnosis, and the employer has under 500 workers, the new paid leave would apply and the employee should stay away from the worksite for 14 days or until testing verifies that they do not have COVID-19. If they call in sick with an illness that is not COVID-19, the new paid sick benefit does not apply and the case should be handled under the employer’s existing sick leave policy. Added 3/30/20 |

SBA ECONOMIC INJURY DISASTER LOANS

Small Businesses and private non-profits are now eligible for SBA's Economic Injury Disaster Loans(EIDL). Loans are available for up to $2 million can help provide working capital to meet the needs of payroll, accounts payable and fixed debt payments until the situation improves. EIDL info sheet attached.

added 3/30/20 Juneau County business opportunity to help in the COVID-19 response effort. Wisconsin’s COVID-19 PPE Program On March 26, 2020, Gov. Tony Evers launched an initiative designed to get more personal protective equipment (PPE) to those working on the frontlines of the response to the COVID-19 pandemic. “It is absolutely imperative that our healthcare workers and first responders have the equipment they need to stay safe and healthy as they care for our communities. As we face a global shortage of PPE, and are competing with other states to acquire limited resources, I am calling on companies, schools, and other organizations that may have unused protective equipment sitting in their facilities to make those materials available to those who need it most,” Gov. Evers said. “The state appreciates any donations, but we are also prepared to pay a fair market value for large quantities of this equipment that are offered.” Wisconsinites can now go to https://covid19supplies.wi.gov/Donations to either donate or sell large quantities of PPE to the State of Wisconsin. The State Emergency Operations Center (SEOC) will then work with distribute the PPE to communities that need it the most. If organizations or businesses have quantities of fewer than 50 of any of these items, they are encouraged to donate them to the Juneau County Emergency Management Office instead of going through the buyback website. Call 847-9393 or email [email protected] The Items in need at both the Wisconsin and Juneau County levels are: Surgical Gowns (S, L, XL, and XXL) Face/Surgical Masks (adult, pediatric) Gloves (Nitrile, Vinyl, or Butyl) N-95 Particulate Respirators Isolation Gowns Face Shields Tyvek Coveralls Thermometers Foot Coverings In addition, Juneau County Responders are in critical need of: Disinfectant wipes, such as Clorox or Lysol, or alcohol based electronic cleaning wipes Alcohol based hand sanitizer Juneau County based law enforcement, fire department and first responder agencies should communicate their PPE needs to the Juneau County Emergency Management office. Medical facilities, including hospitals, nursing homes, assisted living facilities and clinics, should continue using the established process for requesting supplies from the Strategic National Stockpile (SNS). Added 3/30/20 New Guidance from The Department of Labor Today, the U.S. Department of Labor’s Wage and Hour Division (WHD) announced more guidance to provide information to workers and employers about how each will be able to take advantage of the protections and relief offered by the Families First Coronavirus Response Act (FFCRA) when it takes effect on April 1, 2020. See the guidance here. Within the guidance, DOL has clarified that workers are not eligible for the new paid leave or FMLA benefits if they are furloughed, or if an employer closes, whether it’s from lack of business or pursuant to a government directive like the Safer at Home order in Wisconsin.Select the background color of the Content Color Box. Added 3/30/20 SBA Disaster Assistance in Response to the Coronavirus The U.S. Small Business Administration is offering designated states and territories low-interest federal disaster loans for working capital to small businesses suffering substantial economic injury as a result of the Coronavirus (COVID-19). Upon a request received from a state’s or territory’s Governor, SBA will issue under its own authority, as provided by the Coronavirus Preparedness and Response Supplemental Appropriations Act that was recently signed by the President, an Economic Injury Disaster Loan declaration. Click here for the full PDF. Click here for your local contact at SBA. Added 3/30/20 | ||||||||||||

Gov. Evers Launches Wisconsin’s COVID-19 PPE Program

Gov. Tony Evers today launched an initiative designed to get more personal protective equipment (PPE), such as gowns, gloves and masks, to those working on the frontlines of the response to the COVID-19 pandemic.

Wisconsinites can now go to https://covid19supplies.wi.gov/Donations to either donate or sell large quantities of PPE to the State of Wisconsin. The State Emergency Operations Center (SEOC) will then work with distribute the PPE to communities that need it the most.

The state is currently seeking the following items:

If organizations or businesses have quantities of fewer than 50 of any of these items, they are encouraged to donate them to local health organizations instead of going through the buyback website.

Added 3/30/20

Gov. Evers Launches Wisconsin’s COVID-19 PPE Program

Gov. Tony Evers today launched an initiative designed to get more personal protective equipment (PPE), such as gowns, gloves and masks, to those working on the frontlines of the response to the COVID-19 pandemic.

Wisconsinites can now go to https://covid19supplies.wi.gov/Donations to either donate or sell large quantities of PPE to the State of Wisconsin. The State Emergency Operations Center (SEOC) will then work with distribute the PPE to communities that need it the most.

The state is currently seeking the following items:

- Surgical Gowns (S, L, XL, and XXL)

- Face/Surgical Masks (adult, pediatric)

- Gloves (Nitrile, Vinyl, or Butyl)

- N-95 Particulate Respirators

- Isolation Gowns

- Face Shields

- Tyvek Coveralls

- Thermometers

- Foot Coverings

If organizations or businesses have quantities of fewer than 50 of any of these items, they are encouraged to donate them to local health organizations instead of going through the buyback website.

Added 3/30/20

Guidance from Wisconsin Department of Revenue on Tax Payments & Audits

On Friday afternoon (3/27/2020) the Wisconsin Department of Revenue released a new proposed guidance document with several new measures meant to alleviate compliance burdens on Wisconsin taxpayers. Some notable measures include:

You can review the whole proposed guidance document here.

The Department also announced that small businesses can request one-month extensions for sales and use tax returns due at the end of March and April. The Department will not assess late fees or penalties during these extensions. You can see the entire announcement here.

The Department’s actions are a start, but more work needs to be done to protect business liquidity and delay unnecessary compliance costs during this public health crisis. WMC has proposed a series of tax related items in our COVID-19 Relief and Recovery Agenda.

Added 3/30/20

On Friday afternoon (3/27/2020) the Wisconsin Department of Revenue released a new proposed guidance document with several new measures meant to alleviate compliance burdens on Wisconsin taxpayers. Some notable measures include:

- Tax payment installment agreements: The Department wants to remind taxpayers that if they cannot pay their entire tax bill at once, they can file an installment agreement. Taxpayers that already have an installment agreement, but are unable to meet the obligations under that agreement, may request a temporary suspension in payments.

- Audits: The Department has stated they “generally” will not start new field audits on small businesses during the public health emergency.

- Automated collection actions: The Department has stated new levies of assets will not be issued except when revenue agents believe “the state is at risk and immediate collection action is warranted.”

You can review the whole proposed guidance document here.

The Department also announced that small businesses can request one-month extensions for sales and use tax returns due at the end of March and April. The Department will not assess late fees or penalties during these extensions. You can see the entire announcement here.

The Department’s actions are a start, but more work needs to be done to protect business liquidity and delay unnecessary compliance costs during this public health crisis. WMC has proposed a series of tax related items in our COVID-19 Relief and Recovery Agenda.

Added 3/30/20

Dear friend,

I know this is a difficult time for you. I want you to know that now, more than ever, state agencies are working together to help the tourism industry through this public health emergency. This is a rapidly evolving situation and the below list is by no means comprehensive. Instead, I hope it reassures you that agencies are working for you and this is just the beginning.

State agency rapid response that impacts tourism:

The Department of Tourism continues to communicate with our industry both through TW News and directly with CVB and Chamber directors. We also continue to advocate for our industry with other cabinet agencies and the Governor's office as appropriate. These are difficult times and I know all the efforts thus far do not make you whole, but I want you to know that every level of the executive branch is working to help Wisconsin get through this together. It is important to note that this is just the first step. I'm going to keep at this until we've gotten through this together.

What's next in promoting Wisconsin?

The tourism industry is filled with leaders and helpers. As a marketing agency, we will soon launch initiatives that will highlight those helpers while inspiring hope and togetherness during this difficult time.

We are all in this together and together and together we will get to the other side of this.

Sincerely,

Sara Meaney

Secretary-designee

I know this is a difficult time for you. I want you to know that now, more than ever, state agencies are working together to help the tourism industry through this public health emergency. This is a rapidly evolving situation and the below list is by no means comprehensive. Instead, I hope it reassures you that agencies are working for you and this is just the beginning.

State agency rapid response that impacts tourism:

- WEDC held a conference call Wednesday morning to brief small businesses on their small business 20/20 plan and the federal Small Business Administration's loan program. If you missed the call, it can be found here.

- The Department of Workforce development is working fast to field unemployment claims. Additionally, Governor Evers lifted job search requirements and is working with the Legislature to lift the 1-week waiting period for new Unemployment claims.

- The Office of the Commissioner of Insurance continues to work to attempt to lighten the load by ensuring delivery insurance coverage is available to our tourism industry partners whose business evolution suddenly includes product home delivery.

- The Department of Revenue delayed tax day until July 15.

- The Department of Transportation is keeping rest stops open for truck drivers.

- The Department of Natural Resources is keeping state parks and waterways open and waiving entrance fees for parks and trails.

- Governor Evers announced he has launched an initiative to acquire more PPE for frontline COVID-19 workers. Wisconsinites can now go to: http://www.covid19supplies.wi.gov/Donations to either donate or sell large quantities of PPE to the State of Wisconsin and the SEOC to distribute supplies to high-need communities. They are currently seeking: • Surgical Gowns (S, L, XL, and XXL) • Face/Surgical Masks (adult, pediatric) • Gloves (Nitrile, Vinyl, or Butyl) • N-95 Particulate Respirators • Isolation Gowns • Face Shields • Tyvek Coveralls • Thermometers • Foot Coverings

The Department of Tourism continues to communicate with our industry both through TW News and directly with CVB and Chamber directors. We also continue to advocate for our industry with other cabinet agencies and the Governor's office as appropriate. These are difficult times and I know all the efforts thus far do not make you whole, but I want you to know that every level of the executive branch is working to help Wisconsin get through this together. It is important to note that this is just the first step. I'm going to keep at this until we've gotten through this together.

What's next in promoting Wisconsin?

The tourism industry is filled with leaders and helpers. As a marketing agency, we will soon launch initiatives that will highlight those helpers while inspiring hope and togetherness during this difficult time.

We are all in this together and together and together we will get to the other side of this.

Sincerely,

Sara Meaney

Secretary-designee

email from 3/27/20

|

3/23/20 - from JCEDC Below are a list of some best practices as well as some up and coming webinars where you can learn what other businesses are doing to prepare for the worst and hope for the best.

Terry Whipple Juneau County EDC "Worth a Closer Look" PO Box 322, 122 Main St, Camp Douglas, WI 54618 608 427 2070 [email protected] http://www.juneaucounty.com Wisconsin Department of Agriculture, Trade, and Consumer Protection - Covid-19 Toolkit (updated as of March 24, 2020) About this toolkit: This is intended to serve as a resource for agricultural organizations as they prepare for potential impacts of COVID-19 on their business operations. The State of Wisconsin, including the Department of Agriculture, Trade and Consumer Protection (DATCP), continues to monitor the spread of COVID-19 (2019 novel coronavirus) in coordination with the Department of Health Services (DHS) Public Health and other local, state, and federal partners. DATCP’s Emergency Response Group is also working to update the department’s plan to ensure continuity of essential operations. Tips to help Food Service Operators - from Wisconsin Restaurant Association Unemployment - DWD updates https://dwd.wisconsin.gov/uitax/ Local updates regarding COVID-19 and more links, visit Juneau County's home page: http://www.co.juneau.wi.gov/ WI DHS issued Interim Guidance for Emergency Medical Services (EMS) Systems, Practitioners and Public Safety Answering Points (PSAPs) Regarding COVID-19 https://www.dhs.wisconsin.gov/dph/memos/ems/20-02.pdf |